When we talk about homeowners’ community insurance, it is just as important to know the coverages that the company offers you as well as those that are excluded. In fact, the latter is more important to know them to be aware of possible unexpected situations that may occur in the community.

For this reason, as an insurance mediator , we want to make clear the coverages that are usually left out once you contract a homeowners’ community insurance, although each insurer has its own packages when offering its coverage, we will see the more common.

The coverages that do not fall within this type of insurance are the following:

Corrosion in pipes

When you take out insurance with water coverage, it usually covers all damages that occur due to water if it is due to an accident that is not foreseen, water leaks through the pipes, breakage or blockages.

However, the insurance does not cover material damage that is the result of an external problem such as floods, public sewers or any problem that comes from the outside. As we have mentioned previously, insurers are increasingly integrating more coverage and this is one of them.

Rain seepage

If there is a crack in the window, the roof or balconies of your house will also be excluded in the coverage of the homeowners’ community insurance. Except when the filtration is due to rain of more than 40 l / m³.

This is another of the coverages that companies add to integrate them into their insurance packages.

Vandalism

Vandalism must be valued . The community of owners insurance only covers material damage to the continent and its content, produced by acts of vandalism by third parties.

It is not covered by insurance if the building where the damage occurred is disabled or has been done due to the illegal occupation of the building , premises, office or home.

Vandalism will not be considered, at least for the insurance company, damages that have been caused by graffiti, sticking posters or chips.

Claim of delinquent neighbors

Something that the property manager must take into account is that he must collect the debt from the defaulting neighbor before the end of the current contract with the company. The insurance will not claim the fees that have not been paid before the insurance was contracted.

This is important for those farm managers who are thinking of changing insurance, you must first inform yourself of this type of problem.

Theft

This is another problem that causes a lot of controversy since companies are very limited in these situations. Communities often study the possibility of adding this coverage and this influences when hiring homeowners’ community insurance.

If this type of coverage is not available, the community could lose a large amount of money.

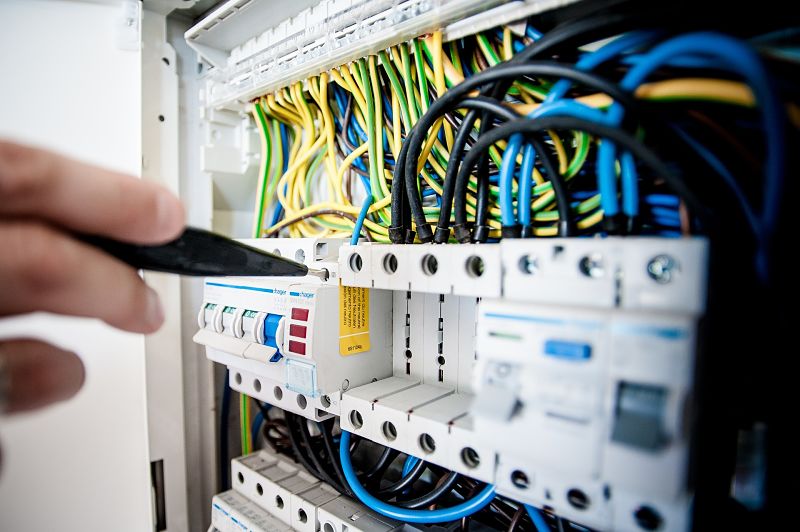

Electrical damage

The insurance of the community of owners will not be responsible for this accident if the electrical installation does not comply with the regulations in force. In addition, assets that are owned by co-owners or tenants of some of the homes are not covered.

we make it clear to you which are the coverages that insurance companies do not include and in this case these are some of them. If you are going to contract a homeowners’ community insurance we give you the best options according to your needs.